Instructions

Follow the instructions to surrender or withdraw funds from a qualified annuity contract.

-

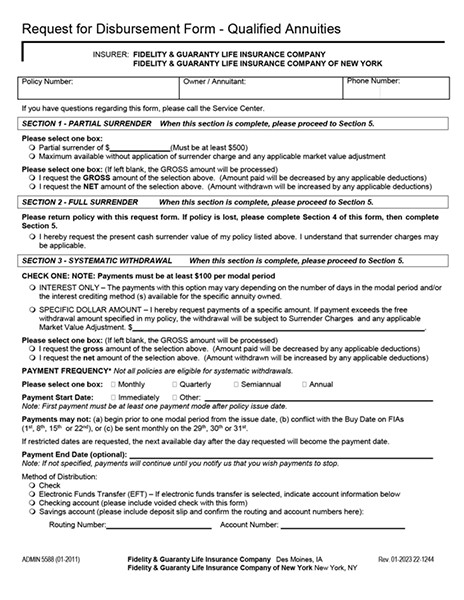

Complete form

Complete the Request for Disbursement form for all non-qualified annuity policies. Fill out all relevant sections on the form as all incomplete forms will be returned. This includes the tax withholding section on page 4 of Request for Disbursement form (ADMIN 5588). -

Type of surrender

Check the box for only one surrender type. The options are partial surrender or full surrender. If you are transferring from a traditional IRA to a Roth IRA, check the "Full Surrender" option along with the "Traditional IRA Transfer to Roth IRA" option. There are four options for partial surrenders: maximum available partial, maximum "penalty free" amount, interest only or a specific amount. Please only choose one option. -

Signatures

If there are joint owners on the policy, both must sign the withdrawal request. If the policy is corporately owned, the signatures of two officers and their titles must be provided. Request from a Power of Attorney (POA) requires that Fidelity & Guaranty Life Insurance Company have current (less than 6 months) POA documentation. -

Submit form

Return the completed forms with any required documentation via U.S. mail, overnight mail or fax to our service center.

Postal mail

F&G Service Center

P.O. Box 81497

Lincoln, NE 68501-1497

Overnight mail

F&G Service Center

777 Research Drive

Lincoln, NE 68521

Fax

402.328.2266

Allow 3 business days for faxed documents to enter our processing system. -

Allow 15 days to process

F&G will process the request within 15 business days of receipt of all required information if in good order. -

Payment

Unless noted otherwise, a check will be mailed to the owner's address on record.

Request for Disbursement - Qualified Annuities

[ADMIN 5588]

Download ADMIN5588

22-0084